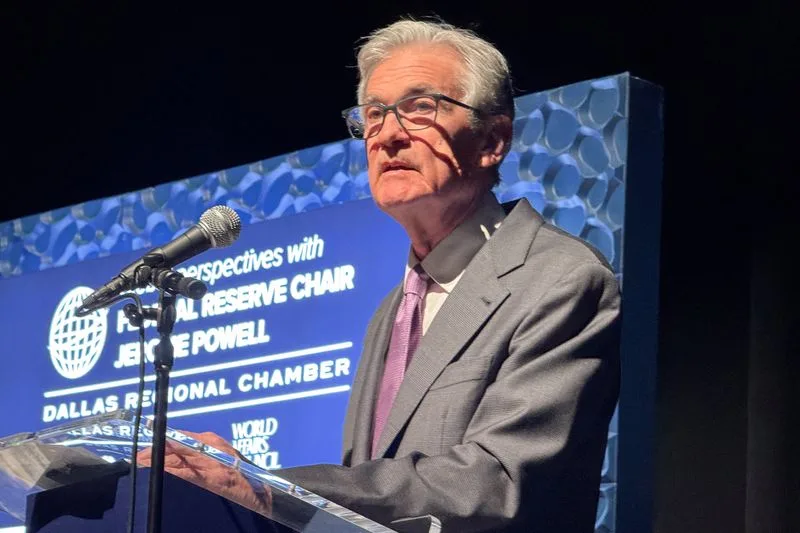

Federal Reserve Chair Jerome Powell has signaled that the central bank is unlikely to rush into cutting interest rates, citing the resilience of the U.S. economy. Speaking at a recent forum, Powell emphasized that the current economic strength—marked by steady growth, low unemployment, and cooling inflation—does not warrant immediate action to lower rates.

Powell acknowledged progress in taming inflation, which has gradually declined closer to the Fed’s 2% target. However, he noted that premature rate cuts could undermine the Fed’s efforts to ensure price stability, risking a resurgence of inflationary pressures. “Our stance is to proceed cautiously and ensure the economic foundation remains strong,” Powell stated.

The Fed’s cautious approach is rooted in a desire to maintain balance. While businesses and consumers may hope for relief from high borrowing costs, Powell stressed that rate adjustments would only come when there is clear evidence of sustained progress in economic stability.

This announcement dampens speculation about rate cuts in the near term but reassures markets of the Fed’s commitment to avoiding policy missteps. As the economy remains resilient, Powell’s message suggests a steady course, with future rate decisions hinging on evolving data and long-term objectives.